One of the greatest things about Haas is not what goes on within, but what happens just a stone’s throw outside of campus. I came to Haas to switch careers, with the goal of moving from consulting to technology. There are plenty of ways to explore new fields, understand industry trends, and make alumni connections. I’ve joined the Haas Technology Club and the Digital Media & Entertainment Club (DMEC), enrolled in speaker series, and plan to take classes in the Management of Technology (MOT) program.

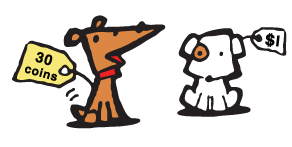

But let’s not forget that the Silicon Valley is in our backyard. And last Friday was a great reminder of this. With the Bay Bridge closed, a bunch of Haas students braved the crowded BART trains to the Virtual Goods Summit. The summit brought together leaders in this emerging space for conversations about the state of the virtual goods ecosystem as well discussed growth opportunities. Projected to be an $1B US industry this year, it’s growing at an incredible pace.

But let’s not forget that the Silicon Valley is in our backyard. And last Friday was a great reminder of this. With the Bay Bridge closed, a bunch of Haas students braved the crowded BART trains to the Virtual Goods Summit. The summit brought together leaders in this emerging space for conversations about the state of the virtual goods ecosystem as well discussed growth opportunities. Projected to be an $1B US industry this year, it’s growing at an incredible pace.

Having walked into the conference with only a general knowledge about the space, I felt as if I was drinking from a fire hose. I realized that much of what we discuss in class: demand curves, willingness to pay, price discrimination, and… even statistics are being used real-time by companies trying to monetize on digital content. The key difference is that shifts in policy don’t take months, years to bring change; change can take place in a matter of hours. To dip into the pool of insight, check out a presentation from Bill Grosso, CTO and SVP of Product, Live Gamer.

I left the summit with a head full of information and had the opportunity to network with thought leaders in the industry. Most importantly, the energy from learning about such a kinetic and growing industry made the 20 minute BART ride home seem to flicker by in 20 seconds.

—Vince